What is inflation and how does it affect small businesses

Published on the 20th of February, 2023

Although the word inflation is often used, what is it exactly?

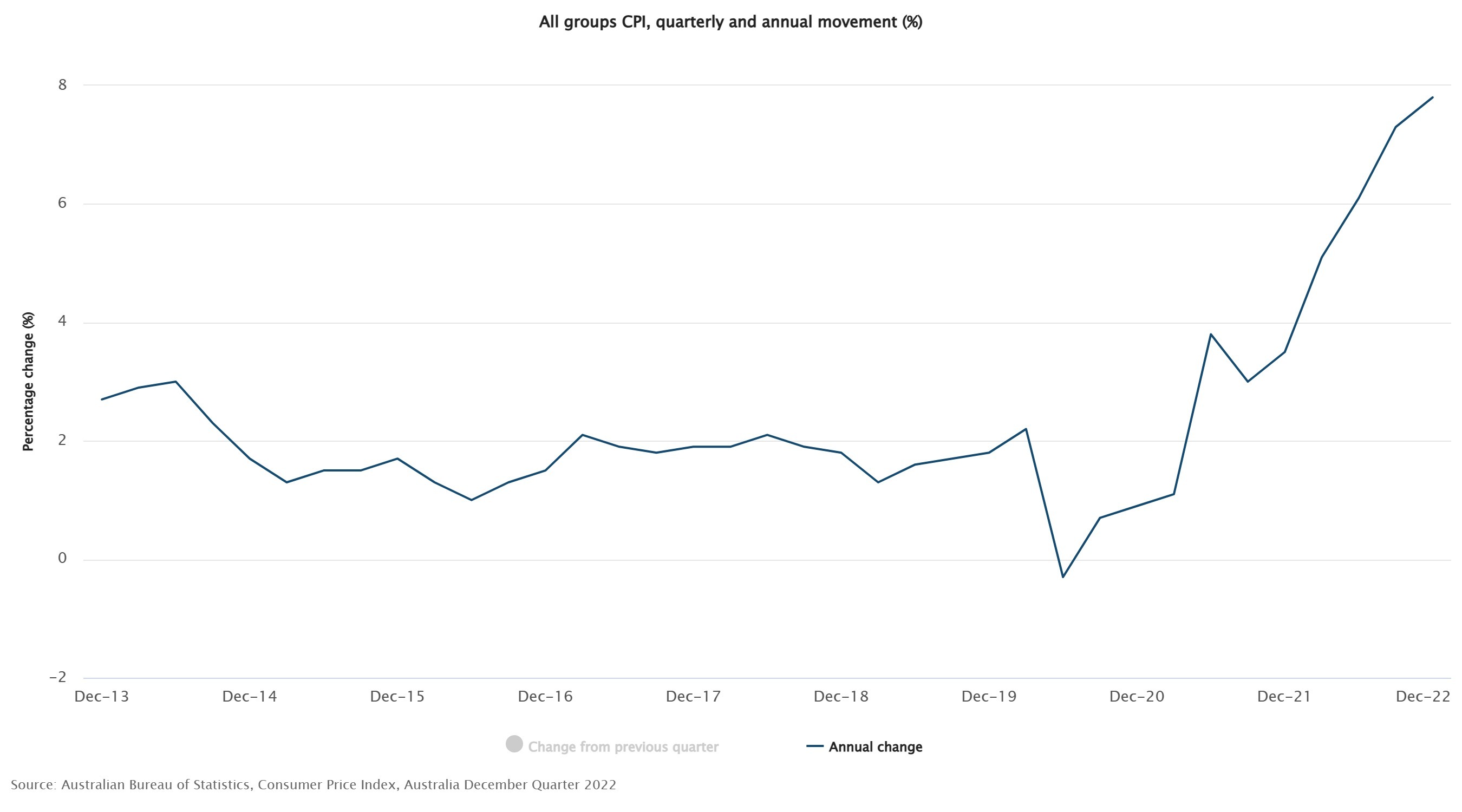

The Australian Bureau of Statistics (ABS) releases a statistic known as the consumer price index (CPI), which is commonly referred to as the inflation rate (see below).

CPI measures the cost of a fixed basket of goods and services. According to the Australian Bureau of Statistics, CPI over the 12 months to December 2022 was 7.8%. So a basket of goods costing $1,000 in December 2021 cost $1,078 in December 2022.

The basket of goods is for an average family, so the things you spend money on might have increased more (or less).

That’s why the ABS also releases selected living cost indexes and a breakdown. For example, the table below shows the breakdown by industry for the capital cities.

What drove inflation in Australia?

The ABS mentions several issues that drove inflation during 2022. Three of them were:

1. Housing

The construction industry had a shortage of labour and materials. Covid-19 lockdowns meant migrant workers couldn’t travel and some manufacturing stopped – hence the shortage from which the industry hasn’t yet recovered. Home building costs jumped 11.9% during 2022, according to CoreLogic’s Cordell Construction Index.

At the same time, renting became much more expensive. During 2022, the rent for a median rental property soared 13.4%, according to CoreLogic

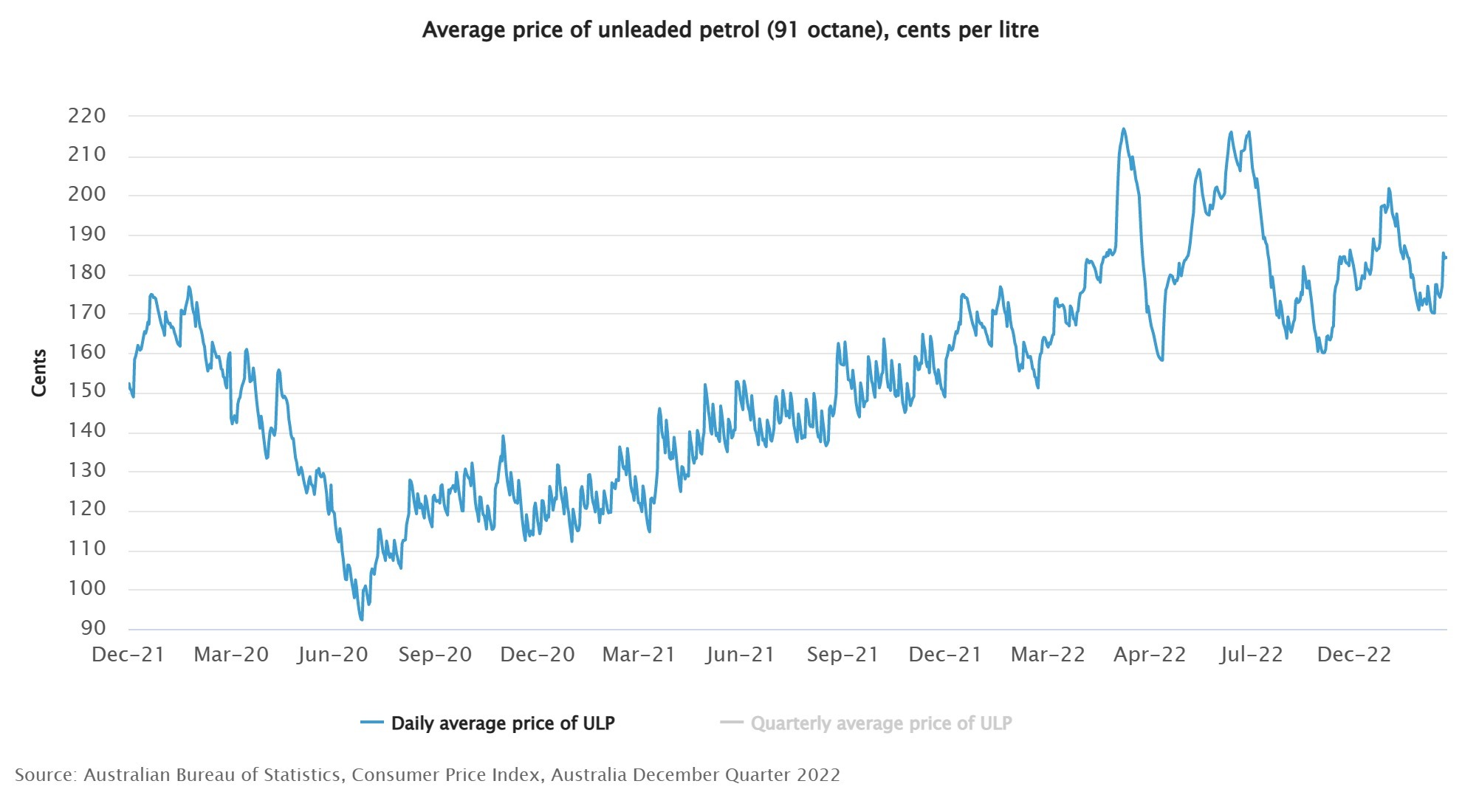

2. Transport costs

When Russia invaded Ukraine, it created a shortage of oil, which pushed up petrol prices. Thankfully, during the second half of the year, prices trended down, although they're still fluctuating (see graph below).

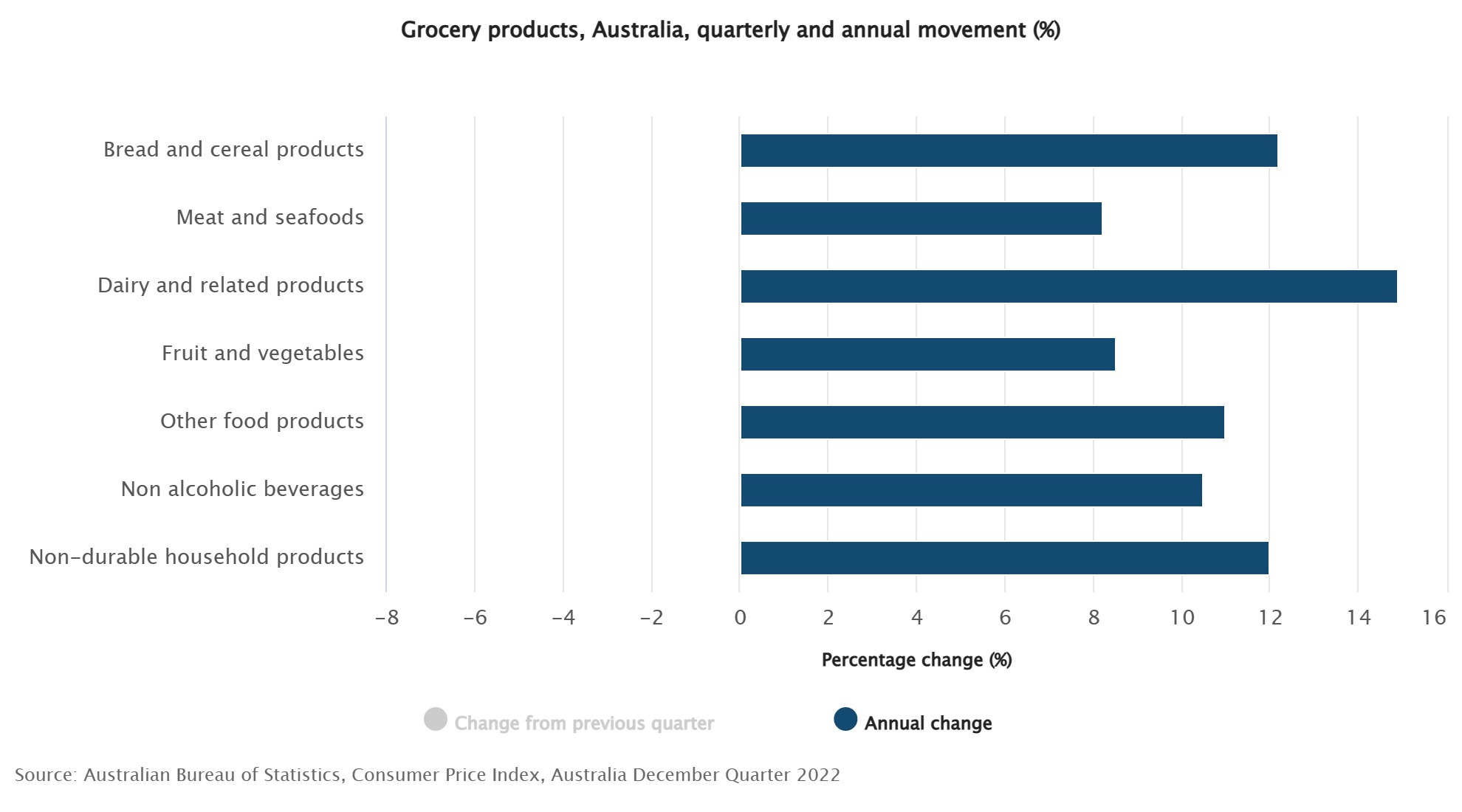

3. Food costs

Increased transport prices meant it cost more to transport food from where it’s produced to where it’s consumed. There was also flooding in some food-producing areas, which reduced the amount of food available. This, and other factors, contributed to the rising cost of groceries (see table below).

Who manages inflation?

The Reserve Bank aims to keep the inflation rate between 2% and 3% on average, over the medium term, because it believes that level of inflation is conducive to a stable economy. So, when inflation is higher, the Reserve Bank may raise the cash rate.

Lenders use the cash rate as a guide, so they will often follow the Reserve Bank’s lead and change their home loan rates in tandem.

It may sound contradictory for the Reserve Bank to try to reduce inflation by making borrowing more expensive, but here’s why it makes sense:

- When people pay more for their home and car loans, they have less money to spend and so buy less

- When businesses make fewer sales, they are less willing to raise their prices

How does inflation impact small businesses?

Small business owners are impacted by inflation in three main ways:

- Owners have to deal with the rising cost of living themselves

- Their business may have to pay more for goods, loans and overheads

- Their staff may demand wage increases to keep up with the cost of living

So what should you, as a small business owner, do?

If your business isn’t making a profit, you should seriously think about increasing your prices – you can always decrease them later.

If you have fixed-price contracts, you may need to look at ways of saving costs instead. So look for wastage in your business, get new quotes for regular expenses and look around for innovative finance options.

Don’t be too quick to raise your staff’s salaries or wages – once increased, you can’t easily decrease them again. If you are giving increases, consider using the Reserve Bank’s targeted inflation rate of between 2% and 3% as a benchmark rather than the current inflation rate of 7.8%.